The smart Trick of Succentrix Business Advisors That Nobody is Discussing

The smart Trick of Succentrix Business Advisors That Nobody is Discussing

Blog Article

The 5-Minute Rule for Succentrix Business Advisors

Table of ContentsMore About Succentrix Business AdvisorsIndicators on Succentrix Business Advisors You Need To KnowOur Succentrix Business Advisors Statements5 Simple Techniques For Succentrix Business AdvisorsThe 5-Second Trick For Succentrix Business Advisors

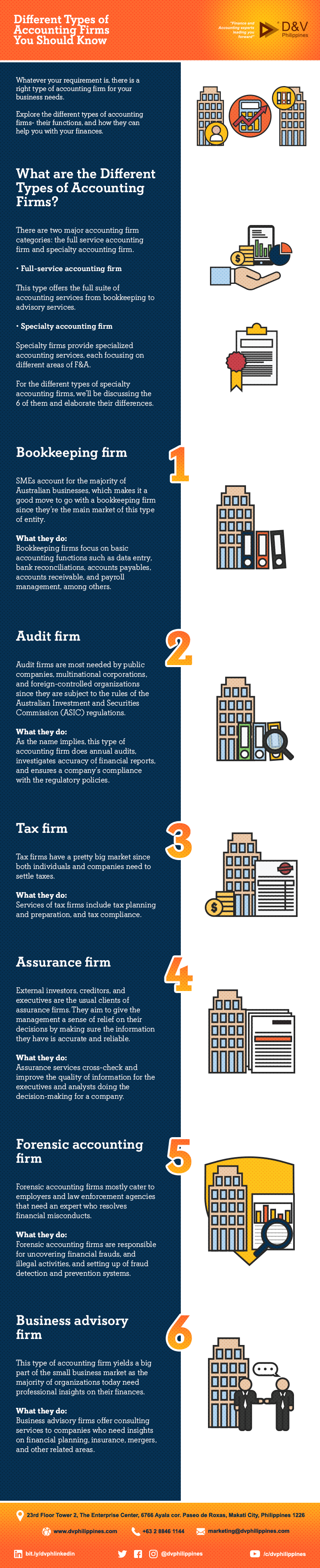

Getty Images/ sturti Contracting out accounting solutions can free up your time, stop errors and also decrease your tax obligation expense. Or, perhaps you desire to manage your general accountancy tasks, like accounts receivables, but work with an expert for cash circulation forecasting.Discover the different kinds of bookkeeping solutions offered and find out just how to select the right one for your small company demands. Accountancy services fall under general or economic accountancy. General accounting refers to routine tasks, such as taping transactions, whereas financial accounting strategies for future growth. You can employ an accountant to go into data and run records or deal with a CPA who gives monetary recommendations.

They might additionally resolve banking statements and record payments. Prepare and file tax returns, make quarterly tax payments, data extensions and take care of IRS audits. Professional Accounting and Tax services. Small company owners likewise examine their tax obligation concern and remain abreast of upcoming changes to stay clear of paying greater than required. Create economic declarations, consisting of the balance sheet, profit and loss (P&L), cash circulation, and earnings declarations.

The Of Succentrix Business Advisors

Track work hours, calculate incomes, hold back tax obligations, problem checks to staff members and make certain accuracy. Bookkeeping services may also consist of making pay-roll tax settlements. In enhancement, you can work with consultants to develop and establish your accounting system, supply monetary planning recommendations and describe monetary declarations. You can contract out chief financial policeman (CFO) services, such as succession preparation and oversight of mergings and purchases.

Typically, small company owners contract out tax solutions first and add payroll assistance as their firm grows. According to the National Small Business Association (NSBA) Small Company Taxation Study, 68% of participants utilize an exterior tax professional or accountant to prepare their company's tax obligations. On the other hand, the NSBA's Innovation and Service Study found that 55% of small service owners manage payroll online, and 88% take care of financial accounts digitally.

Next off, it's time to locate the right audit solution supplier. Now that you have an idea of what kind of bookkeeping solutions you require, the concern is, who should you employ to offer them?

Succentrix Business Advisors Things To Know Before You Get This

Prior to determining, take into consideration these inquiries: Do you desire a local audit specialist, or are you comfy working essentially? Does your organization need sector understanding to carry out accountancy jobs? Should your outsourced services integrate with existing accountancy devices? Do you intend to outsource personnels (HR) and payroll to the exact same supplier? Are you looking for year-round support or end-of-year tax obligation management solutions? Can a specialist finish the work, or do you need a group of experts? Do you need a mobile application or on-line portal to supervise your audit services? CO aims to bring you motivation from leading highly regarded experts.

Use for a Pure Leaf Tea Break Give The Pure Leaf Tea Break Grants Program for tiny organizations and 501( c)( 3) nonprofits is currently open! Concepts can be new or currently underway, can come from Human resources, C-level, or the frontline- as long as they enhance staff member health through society adjustment.

Something failed. Wait a moment and try again Try once more.

Maintaining up with ever-evolving audit criteria and governing needs is important for organizations. Accountancy Advisory specialists help in monetary coverage, making certain accurate and compliant monetary statements.

The Ultimate Guide To Succentrix Business Advisors

Right here's a comprehensive look at these essential abilities: Analytical abilities is an important skill of Accountancy Advisory Services. You need to be skilled in gathering and evaluating financial information, drawing purposeful understandings, and making data-driven suggestions. These skills will certainly enable you to evaluate financial efficiency, determine patterns, and deal notified advice to your customers.

Communicating effectively to customers is an important skill every accounting professional must have. You should be able to communicate complex monetary information and understandings to clients and stakeholders in a clear, easy to understand manner. This includes the capacity to equate economic lingo right into simple language, develop comprehensive reports, and deliver impactful presentations.

Things about Succentrix Business Advisors

Audit Advisory additional resources companies use modeling strategies to replicate different monetary scenarios, assess possible outcomes, and assistance decision-making. Effectiveness in financial modeling is essential for exact forecasting and critical preparation. As an accounting advisory company you need to be well-versed in monetary laws, bookkeeping criteria, and tax regulations appropriate to your customers' sectors.

Report this page